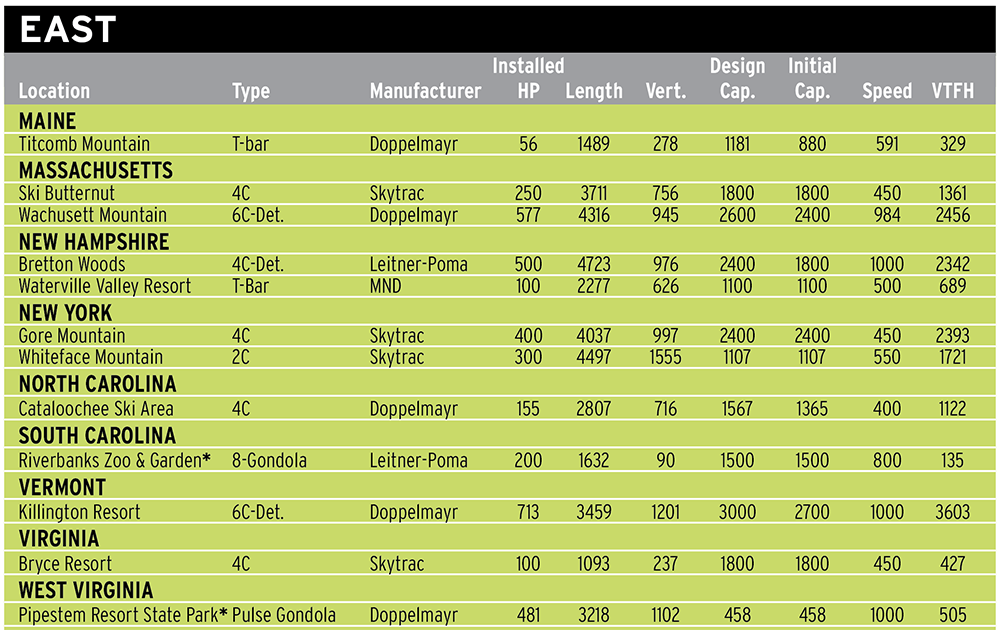

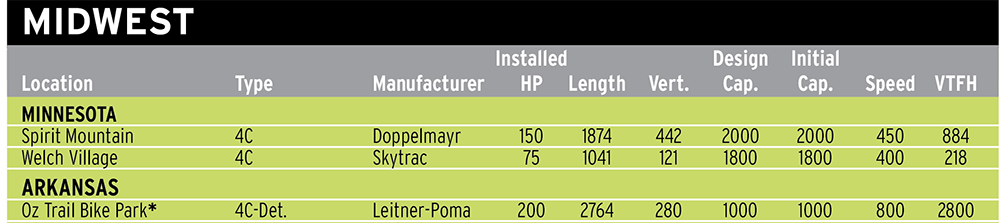

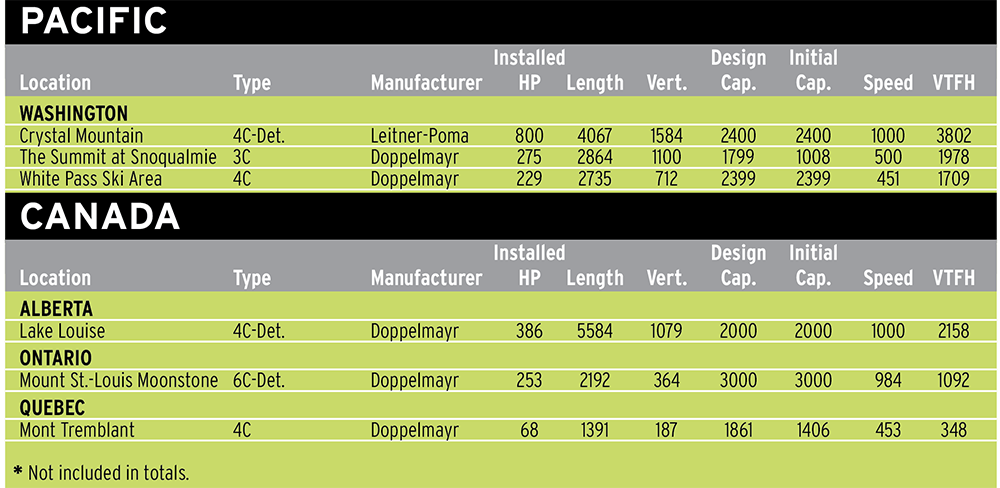

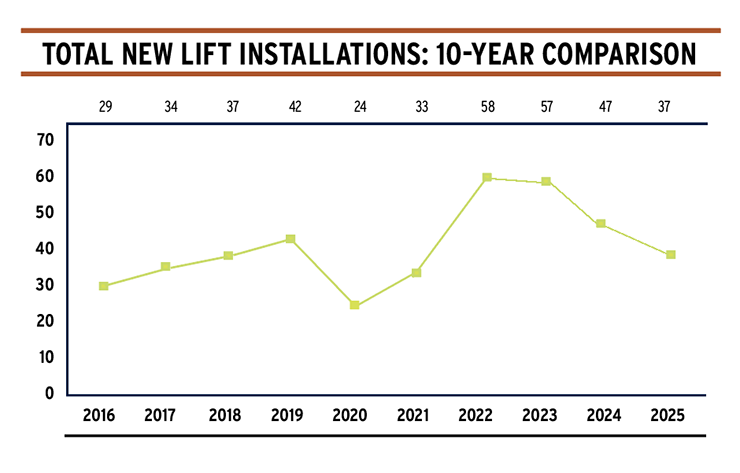

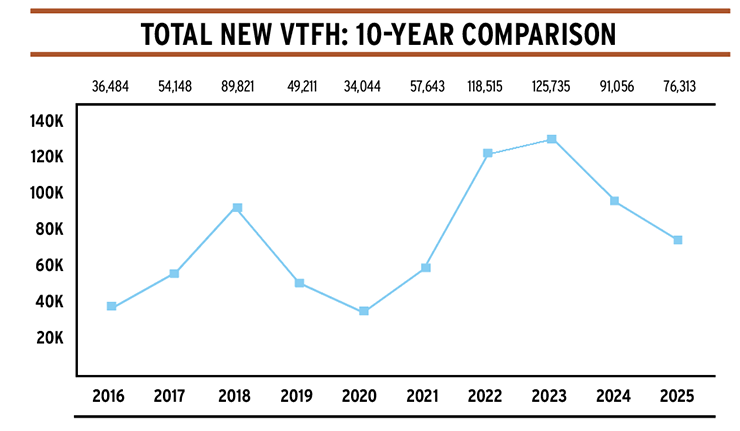

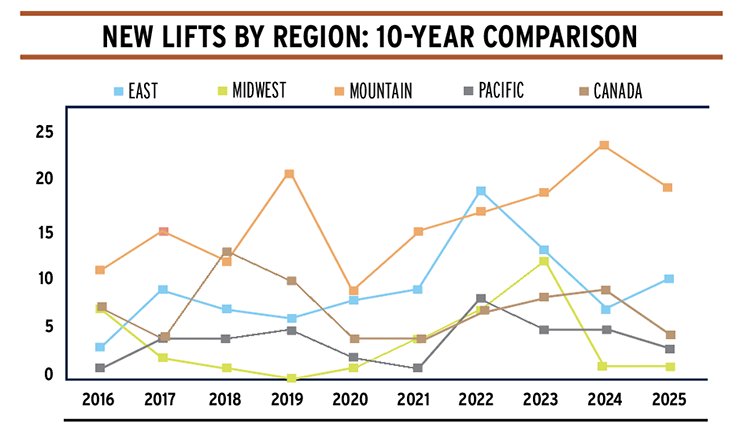

Lift construction returned to pre-Covid levels in 2025 as ski areas and manufacturers faced headwinds of continued inflation and new tariffs. North American ski areas installed 37 new aerial lifts, still up from the early Covid years of 2020 and 2021 but down significantly from the post-Covid boom of the past three years. Installed vertical transport feet per hour (VTFH) declined 16 percent year-over-year, falling most in the Western United States and Canada. The number of Midwest installations was flat, and the East built three more lifts in 2025 than in 2024.

This season’s new lifts trended smaller and simpler with fewer detachables (18 vs. 25), fewer bubbles (1 vs. 4) and fewer loading conveyors (4 vs. 10) compared to 2024. More than half the installations were fixed-grip lifts, and conveyors sold well, emphasizing resorts’ desire to transport guests cost-efficiently.

A Few Exceptions

Some ski areas bucked this trend, replacing older equipment with new detachable lifts, mostly quads, with some exceptions.

Leitner-Poma of America supplied Snowmass, Colo., with a direct-drive six-place chair spanning nearly 1.5 miles to replace the Elk Camp Express quad. Big Sky Resort, Mont., completed the two-segment Explorer Gondola from Doppelmayr, the culmination of a 10-year effort to renew the entire mountain’s lift fleet with premium equipment. In Canada, Mount St. Louis-Moonstone partnered with Doppelmayr on a six-pack with heated seats, raisable loading conveyor and in-station parking to replace two aging fixed grips.

At Park City Mountain, Utah, Leitner-Poma replaced an outdated double chair called Sunrise and extended the line for a 10-passenger, direct-drive gondola.

Deer Valley bonanza. Down the road from Park City Mountain, Deer Valley dropped six detachables and three conveyors into a 2,000-acre eastward expansion. Doppelmayr supplied a two-section, 10-place gondola, a six-place bubble, and three detachable quads in signature Deer Valley green, some with premium features like heated seats and direct drives. With so many lifts to build at Deer Valley East, resort owner Alterra Mountain Company partnered with several local contractors for civil construction, and Doppelmayr brought in teams from around the globe. “Our people focused on building lifts,” notes Doppelmayr USA CEO Keith Johns.

Star Lifts added three SunKid conveyors for the East Village teaching area, all with covered galleries.

With five other lifts completed in 2024 and one more scheduled next year, 15 lifts will have been built at Deer Valley East over three years.

Other notable terrain expansions with new lifts included Richardson’s Ridge at Lake Louise in Alberta (Doppelmayr detachable quad); Davenport at Powder Mountain, Utah (Leitner-Poma detachable quad); and No Name Basin at Colorado’s Monarch Mountain (Skytrac triple).

Left to right: Cabins taking first flight on Deer Valley’s new 10-place Doppelmayr gondola; One of six Doppelmayr lifts built this summer at Deer Valley, Utah.

Left to right: Cabins taking first flight on Deer Valley’s new 10-place Doppelmayr gondola; One of six Doppelmayr lifts built this summer at Deer Valley, Utah.

Keeping It Simple

Fixed-grip doubles, triples, and quads proved popular across North America in 2025. Leitner-Poma completed more Alpha fixed grips than any year since 2019. “We were a bit surprised at the number of fixed grips,” says Leitner-Poma director of sales Michael Manley. “The U.S. market continues to be pretty utilitarian-focused with a few exceptions.”

Fixed-grip specialist and Leitner-Poma subsidiary Skytrac installed six chairlifts this season and would have completed two more if not for permitting delays that arose at Powder Mountain and Purgatory, Colo.

MND, which installed two conveyors and a T-bar in North America this year, is looking to expand into the fixed-grip chairlift business with a U.S.-specific model in 2027, according to Steve Daly, MND director of ropeways for North America. It will come in at a lower price point than the fixed-grip model MND sells in Europe.

It was the first season in five that no customer sprung for an eight-place chairlift. At the other end of the spectrum, Whiteface Mountain, N.Y., built its first fixed double in five years. “The old lift was a double, and they wanted to maintain the classic double experience on that lift line,” says Skytrac president Carl Skylling.

Only one category of lift sold better in 2025 than 2024: T-bars. Doppelmayr, Skytrac, and MND all built T-bars for customers ranging from Aspen to tiny Titcomb Mountain, Maine.

Conveyor sales fell slightly, and customers opted for models with fewer bells and whistles. “We’re selling fewer galleries, fewer specialized heating and lighting options,” says Conor Rowan, president of Star Lifts USA, which installed 29 new conveyor lifts and three tows this year. “Three years ago, 60 percent of our conveyors had enclosures. Now it’s back to 40 percent or less.”

Left to right: Snowmass, Colo., debuted the new Elk Camp Express, a Leitner-Poma direct-drive six-pack chair; The angled mid-station of Big Sky Resort’s (Mont.) two-segment 10-place Doppelmayr Explorer Gondola.

Left to right: Snowmass, Colo., debuted the new Elk Camp Express, a Leitner-Poma direct-drive six-pack chair; The angled mid-station of Big Sky Resort’s (Mont.) two-segment 10-place Doppelmayr Explorer Gondola.

Smooth Sailing

One advantage of fewer installations was on-time completion. During Covid, manufacturers became swamped, and supply chain woes disrupted schedules. “Since 2022, the guiding light of our company has been to meet or exceed contracted load test dates,” says Manley. “Most load tests have been early this year. The Park City gondola was finished the first week in October and it wasn’t due until the first of November.”

Doppelmayr commissioned its first lift of the year at Cataloochee, N.C., in September, with more following in October.

Tariff Trouble

Manufacturers dealt with several rounds of tariffs throughout construction season. The first hit came in March, when President Trump announced a 25 percent tariff on Canadian goods, purportedly over fentanyl flowing into the United States. Canada’s tariff rate was later raised to 35 percent, but many goods, including lift components produced at Doppelmayr’s Quebec plant with mostly U.S. steel, were exempt under the existing United States-Mexico-Canada Agreement.

Canada’s retaliatory tariffs forced Star Lifts to reroute parts that would typically ship from Austria to Canada through the United States. “For us, tariffs have been a huge challenge,” says Rowan. “Especially in that March through July timeframe, it was constantly changing.”

April tariff hit. President Trump’s April unveiling of so-called retaliatory tariffs on dozens of countries included 20 percent on the European Union, 31 percent on Switzerland, and 36 percent on Thailand, all source countries for lift parts bound for the U.S. This shoe dropped just as manufacturers were fanning out to build, and they had no choice but to pay tariffs on goods already in production or transit. Rowan typically found out what the tariff would be on a particular shipment “well after I signed a contract.”

Johns expressed similar frustration. “Tariffs created a lot of angst,” he says. “There wasn’t a lot of clear information that came out up front. Tariffs being implemented with very short notice made it hard to react and to plan.”

June, July adjustments. By June, the President increased a different set of tariffs—Section 232 steel and aluminum tariffs—from 25 to 50 percent, effective on a day’s notice and applied based on metal content in each shipment. High-value haul ropes were hit particularly hard. Manley at Leitner-Poma, which manufactures 85 to 90 percent of its lifts domestically, called the haul rope situation “painful.”

It wasn’t just haul ropes, either. “The remainder of the things we import—chairs, grips, hangers, gondola cabins, gearboxes, and direct drives—were all subject to the reciprocal tariffs,” he says.

The European Union inked a deal in late July to reduce reciprocal tariffs to 15 percent. Tariffs on Switzerland reached 39 percent in August, where they remained until a mid-November deal for 15 percent. “The reciprocal tariffs had a lot of changes throughout the summer,” says Johns. “Sometimes it just depended on when a particular good cleared customs what tariff was applied.”

August tariff hike. Making things worse, on Aug. 19, the Commerce Department added 407 product categories to the list of “derivative” steel and aluminum products covered by Section 232 sectoral tariffs. “It flew a bit under the radar but was effective at midnight,” says Manley. “In one day, ski lift equipment from Europe changed from being tariffed at 15 percent to 50 percent.”

This also impacted conveyor companies, all of which manufacture in Europe. “Prior to [Aug. 19], as long as we were bringing in a complete machine, we weren’t getting hit with the steel and aluminum tariffs because we weren’t bringing raw material in,” notes Rowan. Manley explains that even one grip would be tariffed at different rates—the steel pieces at 50 percent but the composite parts at 15 percent.

“The steel and aluminum tariffs have been the most challenging to understand and work with,” says Johns. “They require getting into a lot of detail on what shipped and where it comes from and what the steel and aluminum content is.” As of this writing, the U.S. Supreme Court was reviewing the legality of April’s “Liberation Day” tariffs, but the Section 232 metal tariffs were likely to remain in place.

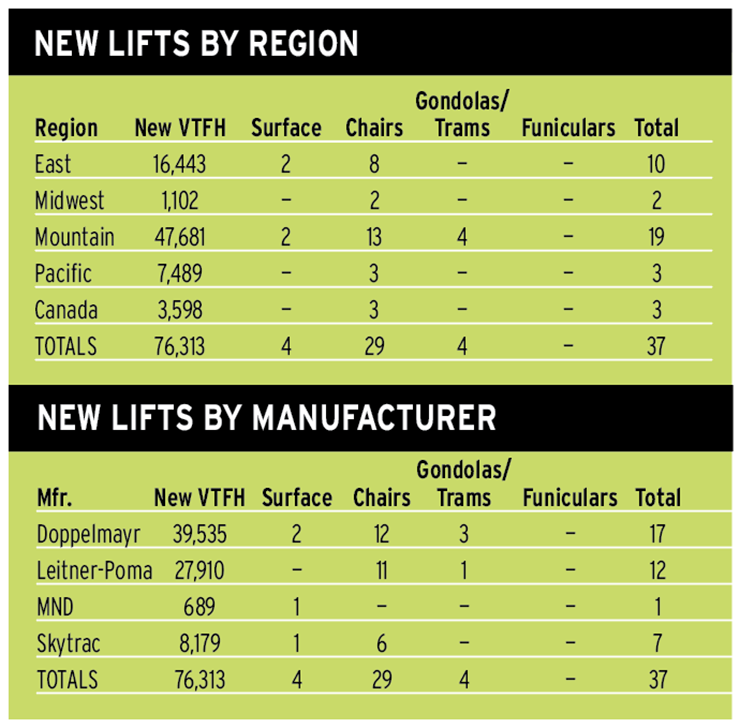

Note: Vertical transport feet per hour (VTFH) measures the number of passengers who can be transported 1,000 vertical feet in one hour. It is derived by multiplying the vertical rise in feet by the lift capacity per hour and dividing by 1,000.

Note: Vertical transport feet per hour (VTFH) measures the number of passengers who can be transported 1,000 vertical feet in one hour. It is derived by multiplying the vertical rise in feet by the lift capacity per hour and dividing by 1,000.

These 10-year comparisons makes it easier to see trends and anomalies. For example, while the number of installations and installed VTFH follow similar relative curvature, they are not directly related. Also notable: Despite the recent decline in new aerial lift installations, North American ski areas have averaged almost 40 new lifts over the past 10 years. The previous 10-year average (2006-2015) was roughly 29 installations, with a high of 38 in 2008. So, historically speaking, a lot of new lifts are still being built.

These 10-year comparisons makes it easier to see trends and anomalies. For example, while the number of installations and installed VTFH follow similar relative curvature, they are not directly related. Also notable: Despite the recent decline in new aerial lift installations, North American ski areas have averaged almost 40 new lifts over the past 10 years. The previous 10-year average (2006-2015) was roughly 29 installations, with a high of 38 in 2008. So, historically speaking, a lot of new lifts are still being built.

Domestic Manufacturing

A stated intent of the tariffs was to incentivize domestic manufacturing, but all three major aerial lift manufacturers note they have been working to onshore more production for years. Leitner-Poma opened a new facility in Grand Junction, Colo., in 2009 and Skytrac debuted its Tooele, Utah, headquarters in 2024.

“We’ve been studying and looking at more efficient production for a number of years,” says Johns. Doppelmayr’s new 160,000-square-foot Salt Lake City headquarters will open later this year. It will house expanded domestic production as well as bring production from Austria, mainly the big D-Line conical towers for now. Just a few months after Salt Lake opens, Doppelmayr plans to debut a new Canadian base in Saint-Jérôme, Quebec, replacing an older building.

Practical limits to onshoring. Despite these investments, North America will always be an outpost of the global ropeway industry. Rowan says SunKid likely wouldn’t bring production to the United States. The U.S. and Canada accounted for 32 of SunKid’s roughly 150 lifts worldwide in 2025. “SunKid wants to purchase and produce everything in Europe with their vendors so they are getting the maximum volume discount when they purchase x material,” he explains.

Haul ropes are another example of when importing from Europe makes sense. “The rope manufacturers here in the U.S. can’t really supply what we need,” says Daly. “As the lifts got bigger, their ropes did not get bigger.”

Skylling says despite using all European ropes this year, he could use domestically produced ropes if necessary. “On fixed grips, even the larger ones, we can use a domestic, we just probably will see stretch and have to go back sometime that first winter and do a shortening.”

Left to right: Nutt Hill, Wis., installed a new SunKid conveyor to serve its ski and tubing hill, which reopened this season after being shuttered for 10 years; Monarch Mountain, Colo., installed a new Skytrac fixed-grip triple to serve its No Name Basin expansion.

Left to right: Nutt Hill, Wis., installed a new SunKid conveyor to serve its ski and tubing hill, which reopened this season after being shuttered for 10 years; Monarch Mountain, Colo., installed a new Skytrac fixed-grip triple to serve its No Name Basin expansion.

Inflation and Competition

Tariffs are just one of the factors that combined to dramatically increase the cost of lifts over the past five years. “Go to the grocery store—inflation is everywhere,” says Manley.

The sharp rise in the price of steel, says Skylling, is the primary factor for the increasing cost of U.S.-made lifts. “The biggest impact we have is the price gouging by U.S. steel and aluminum manufacturers because they now have less competition,” he says. “It’s not tariffs directly, but they’re raising prices a lot—because they can.” From 2020 to 2024, says Skylling, certain components increased in price 30 to 40 percent, averaging to “at least a 20-25 percent increase on the whole picture.”

Labor costs. There is also the cost of labor, which ski areas know all too well. “A ski lift is actually mostly labor,” says Manley. Johns points to materials and labor as the two biggest factors impacting Doppelmayr USA’s prices. “Lifts are significant, long-term investments,” he adds. “Safety is critical when you are carrying people and [lifts] have to function. We can’t scrimp on materials and the quality of what goes into them.”

Exchange rates. Then there’s the weakening of the U.S. dollar in relation to the Euro, a decline of almost 12 percent in 2025 as of mid-December. “In the surface/carpet world, the exchange rate plays a fairly large role in the cost of things,” says Rowan.

Competition. Daly, who started his career at Poma and now works for MND, points to one last factor: lack of competition. “Twenty-five years ago, we went from four major detach manufacturers to two,” Daly says, noting in the early 2000s there was only enough business for two. “As the lift industry has ramped up, there are still only two competitors. Those two companies have dominated the market very smartly,” he says. “We see the need to have a third player in the market.”

Left to right: The new Skeetawk (Alaska) MND conveyor lift nearing completion (credit: Skeetawk Ski Area); Planet Mover’s dual installation at Groupe Plein Air Terrebonne in Quebec.

Left to right: The new Skeetawk (Alaska) MND conveyor lift nearing completion (credit: Skeetawk Ski Area); Planet Mover’s dual installation at Groupe Plein Air Terrebonne in Quebec.

Outlook

How does business look for 2026?

Rowan thinks it’s going to be lower than this year. “I don’t know how much lower, but I anticipate a trend down,” he says, noting he had no large conveyor projects signed as of publication. “Covid flipped the script—we were doing a ton of early orders and had a pile of sales for the next year. We’ve trended away from that,” he laments.

Manley expresses similar sentiments. “The whole industry got reset to a new timeframe during Covid, but we’re backsliding toward later orders,” he says. “I think we’ll end up about the same [as 2025] based on what’s in the pipeline.”

Daly contextualizes that the ski industry did very well during Covid and the influx of cash allowed ski areas of all sizes to move forward with lift projects. However, “2026 will be down,” he says. “There are some things going on in the world that are influencing our market.”

Skylling sees Skytrac’s fixed-grip specialty as reason for cautious optimism. “The detachables have pulled back a bit for a number of reasons, not the least of which are economic conditions in the marketplace,” he says. “Everyone’s reluctant to pull the trigger when they don’t know what’s going to happen with tariffs and such. They’re not signing as early.

“I’m hoping we will be able to achieve similar revenue as we did this year, but I recognize we’re in a unique position with the fixed-grip market,” he says.

Johns, in his first year as Doppelmayr USA CEO, has a few large projects already signed. “2026 is shaping up to be another strong year,” he says, noting interest from independent operators is outpacing the larger conglomerates that invested heavily during Covid. “There’s macroeconomic angst, but many ski areas have long-term capital and infrastructure planning in place and will continue to move forward.”